The world of finance can seem like a huge and difficult maze when trying to comprehend how the stock market operates. A stock split is one of these peculiar financial occurrences. It may seem simple, but many people may not understand how or why it operates. Let’s look at the advantages, disadvantages, and mixed aspects.

The world of finance can seem like a huge and difficult maze when trying to comprehend how the stock market operates. A stock split is one of these peculiar financial occurrences. It may seem simple, but many people may not understand how or why it operates. Let’s look at the advantages, disadvantages, and mixed aspects.

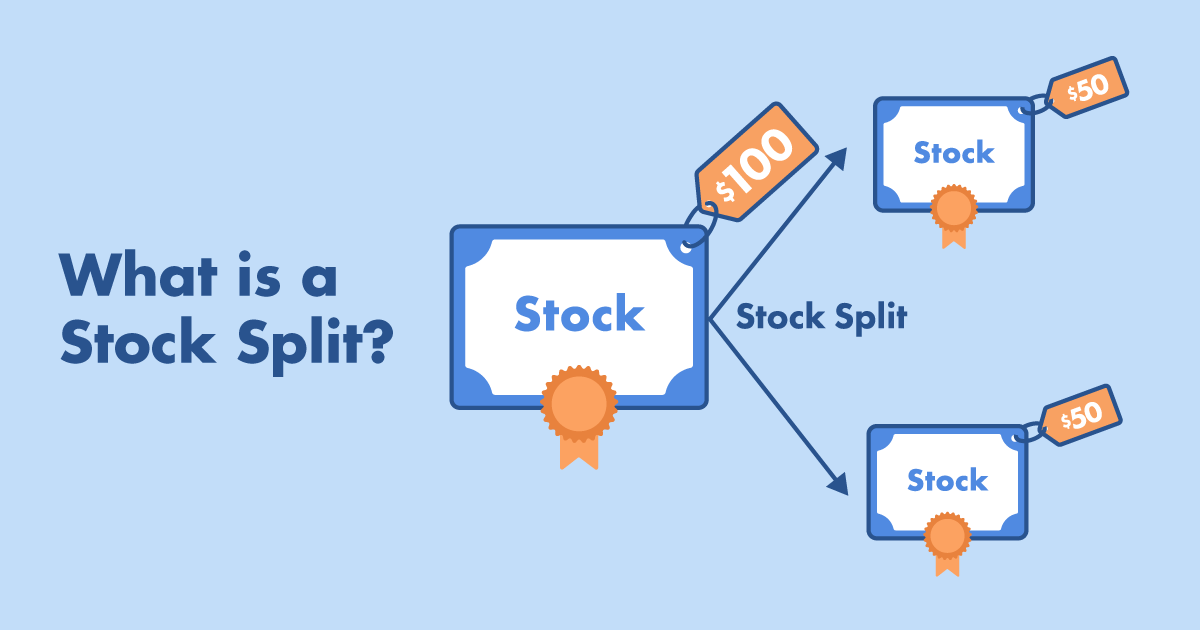

Unraveling the Mystery: What is a Stock Split?

Comparing a stock split to a pizza party where you run out of pizza but your friends keep coming over is a good analogy. Instead of avoiding them, you just chop thinner pieces. The quantity of pizza remains unchanged, but more people can now enjoy a slice. Now substitute “pizza” for “company’s market capitalization” and “slices” for “shares,” and you’ll have a split stock!

By splitting its existing shares into smaller portions, a company can increase the number of shares it owns while keeping the same total market capitalization. It’s like having a magical pizza cutter that divides your one large share into multiple smaller ones without affecting the overall value.

Assume a company chooses to divide its shares two for one. If you had originally owned one share worth $100, then after the split, you would have owned two shares, each worth $50. Even though you invested a total of $100, you now have two shares instead of just one. You still own the same portion of the company as you did before the split; it has just been divided into smaller pieces. Don’t worry, even though each share is now worth less. The reason a stock split is so lovely is that it functions like financial sorcery! But the key, as with all good magic tricks, is to understand the mechanics and not rely too heavily on illusion.

Splitting the Shares: How does a Stock Split Work?

Consider a company that is announcing stock splits. What comes next is this. As per the declared split ratio, the company grants the current shareholders extra shares. Suppose the company rings that bell three times for every one, as every shareholder will now perceive a miraculous conversion of their one share into three. Well done! Naturally, no actual sorcery is at play here. The split is merely reflected in the stock price, which keeps the company’s total market value constant. In our 3-for-1 example, if the starting share price had been a substantial $90, the split would have reduced it to a more reasonable $30 per share. And with that, the stock split generates new shares out of thin air while preserving the company’s overall value. Isn’t it fascinating to watch the dance between numbers and finance?

Unpacking the Motives: Why do Companies Opt for a Stock Split?

We pull back the curtain to examine the rationale behind a company’s choice to dance the stock split waltz. Consider the stock market as an extravagant party where pricey stocks are the ostentatious, exclusive guests. Not all people can interact socially with these financial elites, particularly small-scale individual investors. At this point, a stock split appears on the dance floor. By breaking up an expensive share into smaller, more manageable portions, a company can open up the VIP area and make its shares available to a wider market.

This action shows the company in the competitive market and attracts a larger group of investors. A higher trading volume is possible because there are more shares. More liquidity is necessary to draw in big, institutional investors and preserve price stability. Through a stock split, companies can effectively increase their visibility and volume on the stock exchange stage.

However, there’s more to this astute financial move than meets the eye. A stock split is often seen as an indication of a company’s confidence in the future. It suggests that the company thinks its stock price will continue to rise. Stock splitting frequently generates excitement, optimism, and hope for the company’s future.

As such, a stock split represents a company’s bold entry into the stock market’s grand dance; it is a deliberate move intended to raise the company’s profile, draw in more attention, and communicate its optimistic future prospects. Similar to a well-timed dance move, a well-executed stock split has the ability to captivate an audience and sustain the company’s financial growth momentum.

Weighing the Benefits: What are the Advantages of a Stock Split?

Think of it as a dapper charm offensive on the financial dance floor—a stock split that invites more investors to step up and groove. A stock split lowers the entry barrier and allows smaller investors to compete for the otherwise highly valued VIP shares by dividing expensive shares into more manageable portions. This broader shareholder base not only promotes greater participation but also increases share liquidity, which is critical to maintaining price stability.

But the appeal of a stock split doesn’t end there. It also sends a clear message about the company’s confidence in its future performance. It looks like a thunderous dance move that makes the crowd feel happy and hopeful.

Moreover, a stock split usually takes center stage and briefly grabs the financial markets’ attention. As a result, the company’s stock value might temporarily rise, which would be advantageous to both the company and its shareholders.

Finally, it’s critical to keep in mind that stock split accessibility serves a wider range of users than just outside investors. Employees who have stock options, in particular, might find it more feasible to exercise their rights as a result of the lower share price. This can improve employee happiness and offer rewards for good work, both of which will boost the company’s overall success.

Essentially, a stock split is a two-step in the financial world that can help the employees and possibly attract more customers as well as boost the company’s visibility and positive vibes. It’s an interesting strategy that can help a company keep up a financial growth rate in line with market trends.

What are the Downsides of a Stock Split?

As is often the case in the finance industry, not everything that looks promising always pans out when it comes to stock splits. Although stock splits can increase the availability of a company’s shares and even produce an intriguing dance of numbers, they can also have a slightly deceptive tune. For instance, a split in the stock may appear to be offering “cheap” shares, which could lead unsophisticated investors to believe they are receiving a fantastic deal. But keep in mind that they’re not always a deal—in reality, they’re just smaller portions of the same financial pie.

Moreover, the stock split performance gracefully incorporates administrative costs. Stock splitting involves more work than just shaking a financial magic wand. It necessitates a lot of paperwork and administrative work, which results in real, noticeable costs for the company.

A stock split may not change a company’s intrinsic value, but it can sometimes produce an unsettling solo in the financial orchestra. The reaction of the market to a split in stocks can differ just as much as the music played at a dance party. While some investors may make an immediate investment, others may wait to see what the split might mean for the company’s future. The price of a stock does not always rise after it splits. It may provide you with an immediate boost, but there’s no assurance that you’ll be able to maintain that cadence in the long run.

Thus, there could be a downside to the stock split even though it might appear like a seductive tango, attracting a bigger pool of investors, improving liquidity, and possibly raising the stock price. It might lead to hasty investment decisions, extra costs, and unpredictable market reactions. Understanding the beat of this financial dance as well as its occasional off-beat moments is therefore crucial.

Drawing from Reality: Three Recent Examples of Stock Splits

Allow me to briefly introduce you to some of the most significant figures in the financial sphere from the recent stock split era.

The first stop is the Apple campus in Cupertino, California. With its fifth stock split since going public in August 2020, the tech giant divided shares four for one. With this clever financial move, Apple hoped to make itself more accessible and attract more investors to share in its success.

Now let’s reverse course and go to Tesla’s electric avenue. In the same period, the automotive industry disruptor increased its cash by splitting its stock five for one. What was the result? a sudden increase in Tesla’s share price and trading volume that has piqued investor interest and accelerated the company’s growth.

Now, let’s explore the world of Nvidia, a significant force in the technology sector. Nvidia performed its own stock split song in 2021 with a 4-for-1 split. Their goal is to make it easier for staff members to exercise their stock options and to make the stock more accessible to the general public.

These actual financial examples show how beneficial and useful stock splits can be. Each company was able to raise trading volume, draw in new investors, and reaffirm their commitment to future growth by striking a chord in the financial market. This captivating dance keeps reshaping the stock market, one split at a time.

Next read up on difference between ETFs and Mutual Funds

Leave a Reply