What do American’s spend most of their money on?

I will give you a hint, its not coffee.

Here are a few things most of spend money on.

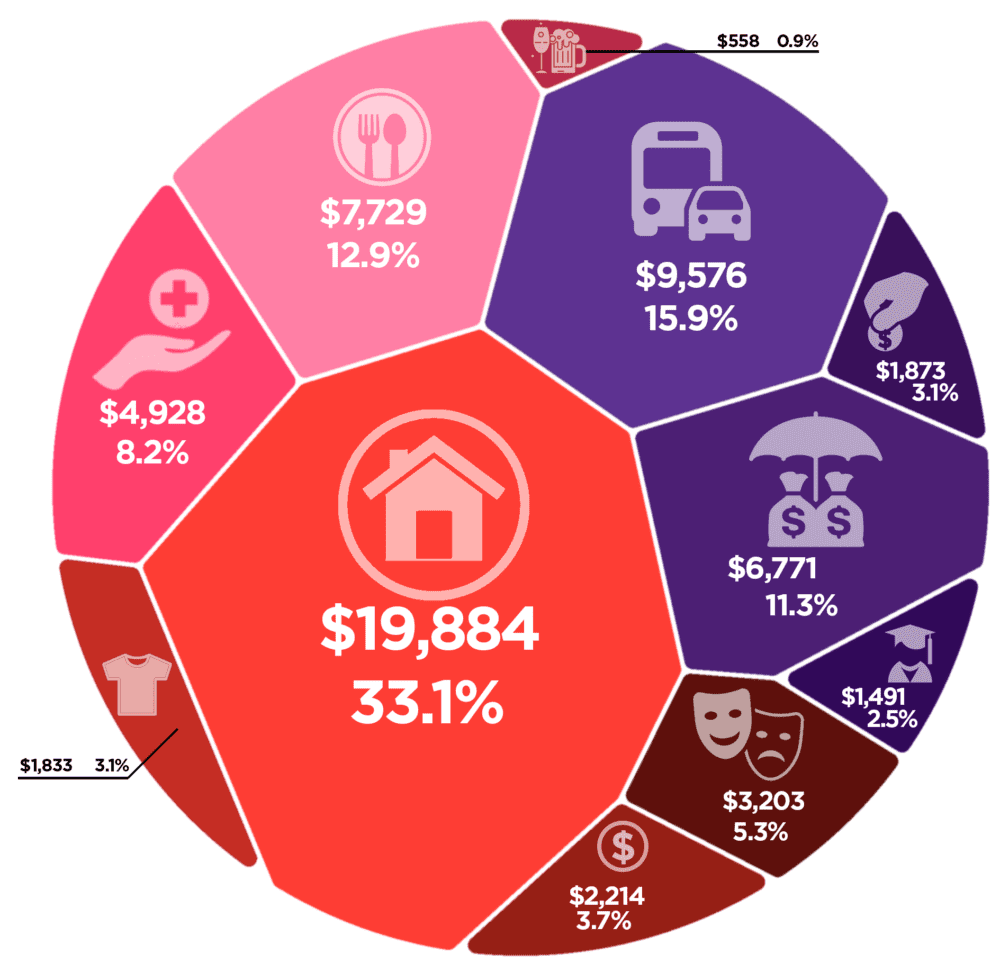

A Snapshot of American Spending Habits

When we take a magnifying glass to American spending habits, we see an intricate pattern of expenditure. The primary chunk of an American’s income is earmarked for housing. This is followed by funds apportioned for transportation, and then food. Insurance and healthcare, despite their vital nature, come next in line. The tail end of this financial serpent is made up of education expenses. After meeting these pressing needs, the remaining budget is spread across a variety of areas, including entertainment, clothing, and personal care. Although these categories may seem less substantial in comparison, they round off the fiscal picture of an average American’s spending habits. The essence of this observation is not to create a hierarchy of needs, but to present a realistic view of how the hard-earned dollar is spent. Remember, this pattern of expenditure can fluctuate based on several factors such as income levels, family size, and lifestyle choices. A one-size-fits-all template of American spending habits is as mythical as the American Dream itself.

Deciphering the Housing Expenditure

Delving into housing costs, we uncover that it’s more than just mortgage or rent payments that carve out a significant slice of an American’s paycheck. This also takes into account expenditures like utilities, furniture, and routine maintenance – the nuts and bolts that make a house a home. But why does housing command such a large portion of spending?

A closer look reveals that rising property values and escalating rent prices, particularly in city areas, are key contributors to these lofty costs. Despite this, many Americans continue to prioritize housing. This is because it’s not viewed as merely a place to rest your head, but rather a long-term investment, a means to accumulate wealth over time.

As we dissect this expenditure further, we find the cost of maintaining a household isn’t uniform across the board. It is influenced by various factors including geographical location, type of housing, and individual lifestyle choices. For instance, owning a house in San Francisco is far more expensive than in rural Iowa. Similarly, maintaining a large family house is likely to cost more than a compact city apartment.

In essence, housing expenditure paints a nuanced picture of American spending habits. It demonstrates the weight many Americans place on securing a comfortable living space and the financial commitments they’re willing to make to achieve it. As we continue to explore other aspects of American spending, we’ll see how this commitment to housing interfaces with other financial obligations and lifestyle choices.

Transportation: More Than Just Cars

The cost of getting from point A to point B can add up quickly for many Americans. Transportation, a fundamental aspect of the American lifestyle, isn’t just about car payments. It encompasses a broader spectrum of expenses. Fuel costs, auto insurance, maintenance, and repairs are integral elements of the cost of owning a car. Additionally, for those living in cities where public transportation is prevalent, the costs of subway tickets, bus fares, or rideshares also form part of this spending category.

America’s geographical expanse and the centrality of cars in its culture make private transportation almost a necessity. As a result, auto-related expenses carve out a significant portion of an average American’s budget. In suburban and rural areas where public transportation might be less available, owning a car is often the only viable option, further augmenting the role of transportation in the list of significant expenditures.

Interestingly, the costs associated with transportation can fluctuate considerably, often mirroring the volatile nature of fuel prices and varying insurance rates. A spike in fuel costs or a sudden hike in auto insurance premiums can significantly affect the monthly budget, underscoring the fluid nature of this expense category.

Of course, it’s not just the necessities that dictate transportation spending. Lifestyle choices and personal preferences also play a role. For instance, those who prioritize eco-friendly living might choose electric or hybrid vehicles, potentially incurring higher upfront costs but saving on fuel in the long run. On the other hand, those with a penchant for luxury cars might find themselves dealing with higher-than-average maintenance and insurance costs.

In essence, the transportation spending of Americans is a complex amalgamation of necessity, choice, and circumstance. It’s a reflection of not only the geographical and infrastructural realities of the country but also the lifestyle preferences and priorities of its people. Understanding these nuances provides a richer perspective on the multifaceted nature of American spending habits.

Food Expenditure: Eating In vs. Eating Out

The culinary spending habits of Americans can be broadly divided into two categories: purchasing groceries for home-cooked meals and dining out at restaurants or fast food chains. Both areas carry their own weight in the overall food expenditure, painting a comprehensive picture of how Americans fuel their bodies and satisfy their palates.

Purchasing groceries for home cooking is a significant staple in the budget. The ingredients required for meal preparation, the occasional need for special dietary items, and the lure of impulse buys in the supermarket aisles all contribute to this expense. It’s not merely about keeping the fridge stocked; it’s about the choices made during every shopping trip. Organic produce, brand-name products, and gourmet items can inflate the grocery bill, reflecting personal preferences and dietary habits.

Simultaneously, the culture of dining out also feeds into the food expenditure of Americans. The convenience of a ready-made meal, the social experience of dining with others, and the desire to explore diverse culinary options are all factors that drive this spending. It’s not just the occasional fine dining experience that adds up, but the regular visits to neighborhood bistros, coffee shops, and fast food joints. Each takeout order, drive-thru meal, and restaurant check significantly contribute to the overall food cost.

What’s intriguing is the interplay between eating in and eating out. Depending on lifestyle choices, work schedules, and even social factors, the scales may tip in favor of one over the other. For instance, a hectic work week might mean more takeout meals, while a quiet weekend might inspire more home-cooked dishes.

In the end, food expenditure, like all aspects of American spending habits, is a complex blend of necessity, preference, and circumstance. Whether it’s stocking up on groceries for a home-cooked meal or enjoying a night out at a favorite restaurant, every decision plays a role in shaping the culinary financial landscape for Americans.

Insurance and Healthcare: A Necessary Expense

Navigating the labyrinth of insurance premiums and healthcare costs is an integral aspect of the American financial landscape. This component of spending isn’t merely an arbitrary expense; it’s a necessary safeguard. In a nation where health insurance is primarily privatized, the cost of maintaining comprehensive coverage can consume a significant portion of an individual’s earnings. However, the expense is widely regarded as a necessary trade-off for the protection it offers against unforeseen medical emergencies.

There’s an intricate dance between the factors that constitute the healthcare spending category. Prescription medication costs, regular doctor visits, and preventative health measures like screenings and vaccinations all play their part. Additionally, the growing cost of mental health care, a previously overlooked area, has also emerged as a key player in this financial dance.

Also intertwined in the narrative of healthcare spending is the cost of insurance premiums. These costs can vary based on factors like age, pre-existing conditions, and even the choice of healthcare provider. For many, the challenge lies not only in affording these premiums but also in understanding the complex world of copays, deductibles, and out-of-pocket maximums.

It’s not only individual and family health insurance that falls into this category. Life insurance, auto insurance, and homeowners or renters insurance also find their place in this domain of American spending. Each of these insurance types, while different in nature, shares the common trait of offering financial protection against unexpected events.

However, it’s essential to remember that the scale of insurance and healthcare costs can significantly differ from person to person. Factors such as age, general health condition, chosen lifestyle, geographical location, and income level all influence the nature and extent of these expenses.

Indeed, the realm of insurance and healthcare costs is a complex one, filled with nuances and fluctuations. Yet, it remains an indispensable part of the American financial landscape, highlighting the degree to which individuals prioritize health security and financial protection. As we further explore the dynamics of American spending habits, the role of this necessary expense continues to reveal itself, underscoring its pivotal place in the financial puzzle.

The Impact of Demographics on Spending Habits

The interplay of demographics and American spending habits presents a compelling narrative. Elements like age, geographical location, and income levels, to name a few, significantly influence the pattern of expenditure. For example, younger Americans are often observed to allocate more funds towards education and technology – fields that resonate with their current life stage and priorities. In contrast, older Americans, especially those in retirement, may find a larger part of their budget absorbed by healthcare expenses.

Similarly, the urban-rural divide also shapes the financial landscape. Those residing in bustling urban environments may grapple with steeper housing and transportation costs as compared to their rural counterparts, who might enjoy the benefits of lower cost of living but face challenges in terms of access to amenities. This geographical influence on spending extends beyond the city boundaries to state lines and regional divisions, painting a diverse picture of expenditure across the country.

Income levels, another crucial demographic factor, significantly dictate the nature and extent of spending. Those with higher income levels may have the flexibility to allocate more funds towards luxury items, recreational activities, and investments. In contrast, those with lower income levels may find their budget significantly earmarked for essential needs such as housing, food, and healthcare.

While this correlation between demographics and spending habits provides a broad understanding of American expenditure patterns, it’s important to remember that these are averages. The individual financial footprint can be far more nuanced, influenced by personal preferences, lifestyle choices, and unforeseen circumstances.

Exploring the interrelation between demographics and spending habits offers a more holistic view of the American economic landscape. It underscores areas of financial pressure while simultaneously highlighting opportunities for economic growth and financial stability. The true beauty of understanding these patterns lies not just in deciphering the present but also in forecasting future trends and preparing for the financial challenges and opportunities that may come our way.

If you are worried about over spending. Learn how to make a budget by clicking here

Leave a Reply