‘You gotta do it’: Charlie Munger once said your first $100K is the toughest to earn — but most crucial for building wealth. Saving The First $100K Is The Hardest

One of the best ways to get rich is to invest, but it’s not always easy to get rich. For example, if you have never invested money before, it can seem very hard to put away your first $100,000. But getting to this point is the most important because it can make it easy to get rich after that.

The cause? Interest that builds up. Your money will grow at a faster and faster rate if you keep it saved. At some point, the interest you get might even grow faster than the money you put in. But before that can happen, you need to get past the mental and financial problems that are stopping you.

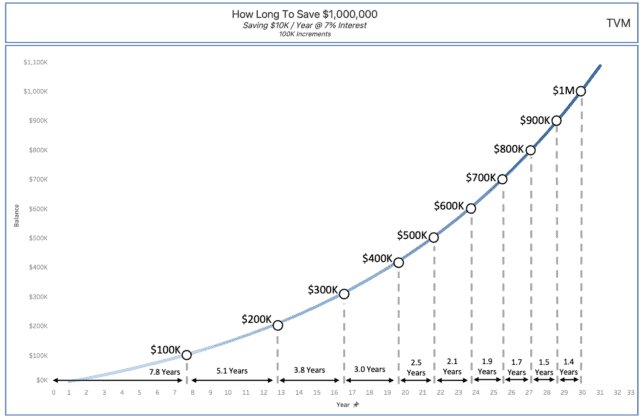

The Math

Take Joe, one of our friends, who saves and invests $10,000 a year. In 7.84 years, his net worth will reach $100,000 at a rate of 7% per year.

After putting away $10,000 a year at an interest rate of 7%, Joe will have enough saved to buy his next $100,000 in just 5.1 years.

As time goes on, Joe will be able to save each additional $100k in shorter and shorter amounts of time.

As compound interest takes it course. Getting the next 100k gets easier and easier as time goes on.

3 Strategies To Help Save The First $100K

Here are three things I’m doing to help me reach my first $100,000 goal.

1. Establishing Good Financial Habits

To save your first $100,000, you need to be consistent and follow through.

We have to do most of the work up front because compound interest doesn’t start to work until we have saved a sufficient amount of money. You can’t get around it.

Because of this, it’s important to start early on with good money habits that will help you get rich.

Automating my investing was one of the most useful skills I picked up.

For me, this meant setting up my 401(k) so that a percentage of my paycheck would be immediately taken out and invested in a few low-cost mutual funds. I was able to save my first $100,000 so quickly because of this. It only took me 15 minutes from start to finish.

I also got into the following good money habits, which helped me:

- Not getting into debt at all costs

- I pay off my credit card in full every time.

- With an emergency fund, I didn’t have to change how much I put into my 401(k) to get extra cash.

- There is a post I made about some of my favorite personal finance books that can help you learn the basics of money management if you are just starting out.

2. Increasing my Income

Increasing my income is one of the best ways to save our first $100,000.

That’s because I can only cut our costs so much before we start to feel bad about our money.

Here’s what I did to get those raised pay:

Learn skills that are hard and useful

Don’t be afraid to switch jobs at your company.

Change how you work: be smarter, not harder.

Learn how to talk to people clearly.

Don’t forget that you are your own best friend.

If you want to know more about how I put those ideas into action, check out my post called “My Strategy for 15% Annual Raises: 5 Actionable Tips.”

Picking a high-paying job that doesn’t require a college degree is another good idea.

3. Decreasing Expenses (Especially the Big Ones)

Being honest, I don’t really like it when people say “cut your costs.”

Because most of the time, the suggestion is something like “give up avocado toast and lattes, that’s how you get rich!”

It’s not, as you already know.

We should instead work on lowering the costs of the things that add up to the most of our bills. The average American family spends 63.5% of their income on living, transportation, and food. A budget is one really good way to do this.

A 900-square-foot, one-bedroom, one-bathroom condo was my first rental when I first moved out on my own. Because of this, I paid $800 to $1000 less than what other “luxury” condos and flats in my area were for.

In the end, if we want to really cut our costs, we need to cut the ones where most of our money is going. If not, we’re just being cheap and not smart.

Final Thoughts:

Setting aside the first $100,000 is not an easy task, but it is essential if you want to begin truly building wealth.

But don’t believe me.

When asked what his best piece of advice was for getting rich, Charlie Munger, who worked for Warren Buffet, said: “The first $100,000 is a b*tch, but you gotta do it.”

Leave a Reply