So many people want to make money while they sleep, and lets face it most side hustles don’t generate a lot of wealth. They are great for building up wealth but require you to spend a lot of time and energy doing that thing in order to earn money. But what if there is a way to earn money in your sleep? While walking the dog? While doing your side hustle?

There is such a way, however be warned it does take some time to get there. Wealth is not built over night and blood sweat and tears will need to be poured into this to make this work.

Dividend Investing is one of the best way to make money in your sleep, while walking the dog, or anything else you can imagine.

How to pick a dividend stock?

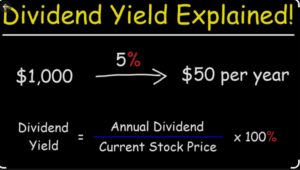

When picking dividend stock one of the most important things to keep in mind is that yield is one of the most important factors to consider. Dividend yield can make or break the attractiveness of a dividend stock.

Compound interest and Time are your friends

The beauty interest is where eventually your money makes you money, and then that money makes money and so on and so forth.

A easy way to see this is 10% interest return on investment per annum. So lets say we have $100 as a start gives you $110 at the end of the first year, $120 at the end of the second year and so on and so forth.

The Best Way to get There:

At some point, your stocks will reach a level where the compound interest and the growth on it per month are going to be more money than you can earn working a 9 to 5 job. That’s the ultimate goal.

The way you can do this is to :

- Make a budget and make sure you have enough money to invest. Pay off debts first if you need more money to invest. This can take time, but building wealth is slow and steady race not a quick one

- Keep on investing a fixed sum consistently on a monthly basis. If the market is up you invest, if the market is down you invest. Basically HODL and diamond hands

- Make sure you never sell or spend any of the money earned from the dividend. Instead reinvest the money by buying more stock. This is referred to as the DRIP method

Just how much does it take to live off of dividends?

Annual Income You Want / Dividend Yield = Amount You Need Invested

Now here is an example if you want to earn $1,000 per year in dividend income.

So how much exactly do you need to live off of dividends?

For most people, $40,000 to $70,000 can afford them to live virtually anywhere in the world.

For this we need to use the 4 % rule, using this rule most people would need about $1 million dollars to live off dividends comfortably.

So if you want 70k per annum in dividend income you would need:

70,000/0.04= $1,750,000

If you want 200k per annum in dividend income you would need:

200,000/0.04=$ 5,000,000

Conclusion

If you take $5,000 and then continued to contributed about $1,500 every single month for 25 years with a dividend return of 4% and an average growth rate of the stock 8% and the average growth rate for the dividend, in about 25 years that $5,000 would be worth $1.4 million.

And at that point, you would have an average annual income of $57,000, all completely passive dividend payments, and you could finally become financially free.

While it does take a while to build, starting right now you can do it too. And that doesn’t have to be your only source of income. If you wanted to retire earlier by paying off more debt saving more and investing more you could do it in 10 years or even less.

The best time to plant a tree was 20 years ago. The second best time is now. So don’t wait, starting planting your financial tree today.